Automatic Tax Collection for “Applied For” Tax IDs

We’ve made it easier to ensure taxes are collected for newly entered tax IDs previously in “applied for” status.

OVERVIEW

Our latest update makes it easier than ever to ensure taxes are collected for newly entered tax IDs previously in “applied for” status. With Namely’s new “applied for” automation, uncollected amounts from the current quarter are now collected automatically on your next standard pay cycle.

HOW IT WORKS

If you’re in the process of setting up new taxes for your organization but still waiting to receive tax IDs from new jurisdictions, Namely allows you to note that the ID has been “applied for” by:

-

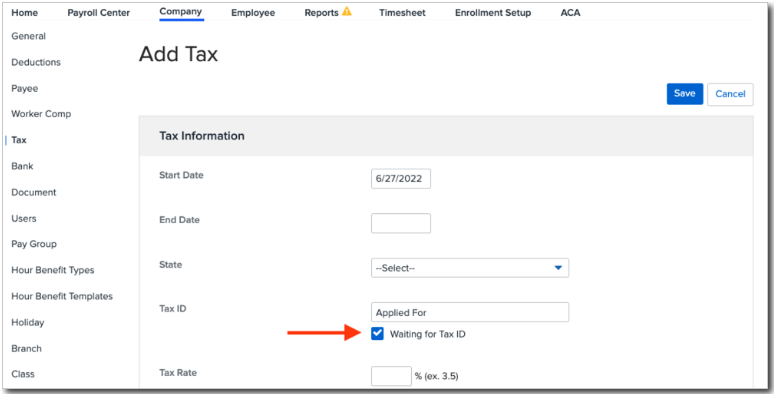

Navigating to Payroll > Company > Tax > Add Tax.

-

Selecting the Waiting for Tax ID option.

Since Namely cannot collect taxes until you enter a valid tax ID, previously, funds for uncollected amounts needed to be wired to Namely after a new tax ID was entered.

With our latest release, these amounts will now be collected automatically.

Automatic Collection

Namely now automatically collects previously uncollected amounts from the current quarter on your next standard pay cycle once you enter a new tax ID.

-

To learn how to enter a tax ID in Namely, visit Adding and Editing Company Tax Codes and Rates in Namely Payroll.

-

Note that if the current pay cycle is already open before you update the “applied for” tax with a new ID, you must reset the pay cycle for these taxes to be recorded and collected.

Improved Reporting

We’ve made finding your previously uncollected amounts easy with the new Applied For Collections Report, which:

-

Shows a breakdown of all collected taxes that have changed from “applied for” to active.

-

Can be viewed in both the Pay Cycle and Date Range reports section.

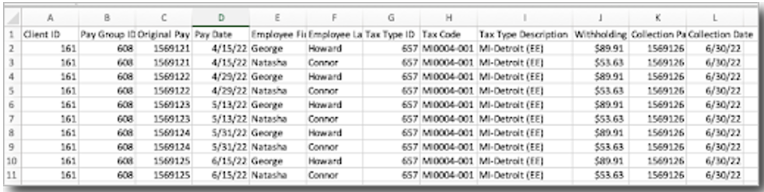

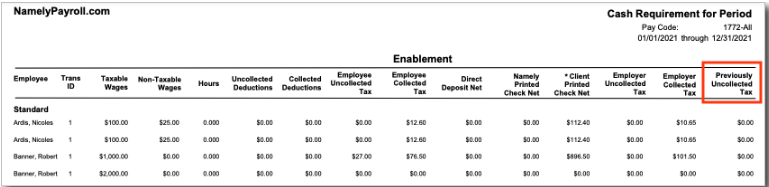

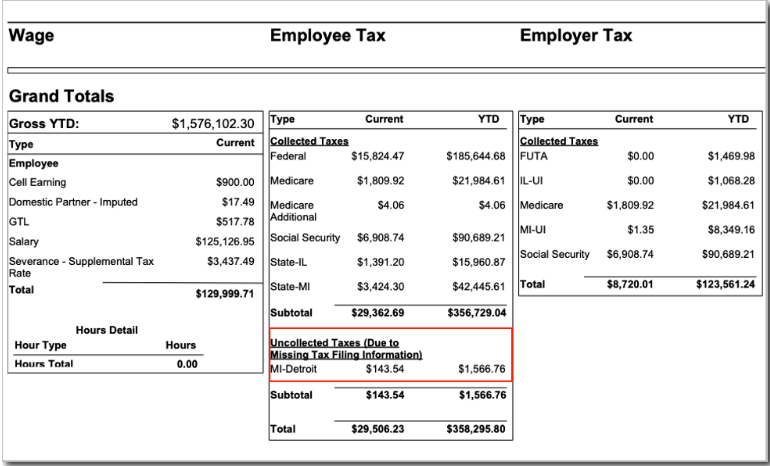

Previously uncollected taxes also now appear as a line item on multiple existing reports, including:

-

Cash Requirement

-

Payroll Register

-

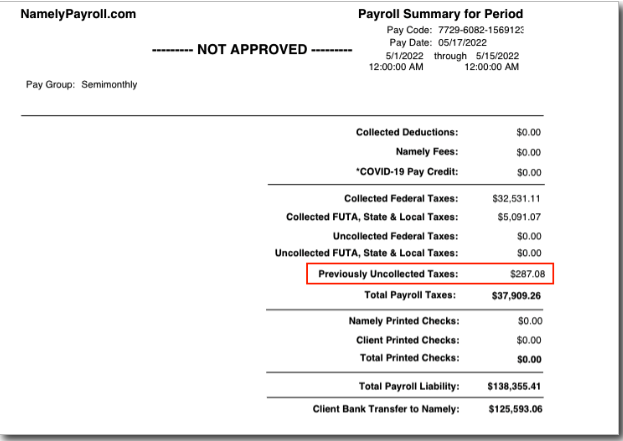

Payroll Summary

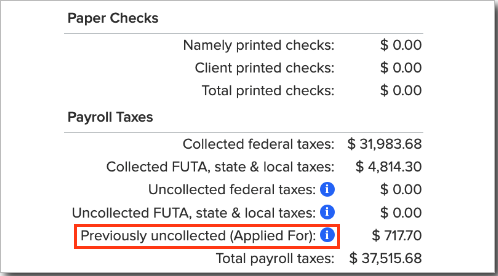

You can also view previously uncollected amounts in step 3 of Payroll, where the line item appears on the Payroll Summary as Previously Uncollected (Applied For).

IMPORTANT NOTES

Please note: Only uncollected funds from the current quarter will be collected from your next pay cycle once the tax ID is entered.

If you have already paid the uncollected funds to the agency directly, please submit a case Help Community by selecting Payroll > Taxes > Tax Services > Function > Applied for Recollection with the details of the tax you have paid, so your ‘uncollected’ tax can be updated in Namely Payroll to accurately reflect that you have paid.

Also, note that only taxes from the current quarter and onward will be filed once the tax ID is entered. If tax IDs are still in "Applied for" status at the quarter close, Namely cannot file taxes for those jurisdictions at that time.

Additionally, Namely does not automatically backfile for any missed quarters after new tax IDs are provided without your specific request. To request that Namely backfile on your behalf, submit a case in the Help Community by selecting Payroll > Taxes > Tax Services > Function = Applied for Recollection.

Be aware that certain situations may also still require you to wire funds to Namely after tax IDs are entered, including:

-

Uncollected amounts remain from previous quarters.

-

No scheduled pay cycles are left in the current quarter when you enter a new tax ID.

To learn how to locate amounts owed from previous quarters and for instructions on how to wire funds to Namely.

TIP:

Need help with tax IDs? We offer an additional service to help you register for IDs for SUI, state, and local jurisdictions. Visit our Tax Registration Services Overview to learn more!